reverse sales tax calculator texas

Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price. You obviously may change the default values if you desire.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. Please check the value of Sales Tax in other sources to ensure that it is the correct value. Input the Final Price Including Tax price plus tax added on. Reverse Sales Tax Calculator Remove Tax.

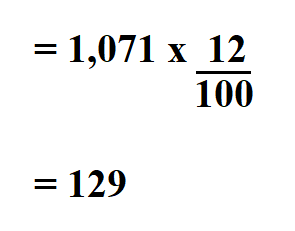

Amount without sales tax GST rate GST amount. Reverse Sales Tax Computation Formula. Tax 758 tax value rouded to 2 decimals.

Firstly divide the tax rate by 100. Here is how the total is calculated before sales tax. This is not fair to me and others that Zillow cannot do a little.

Reverse Sales Tax Calculator Remove Tax. Tax 101 0075. Input the Tax Rate.

We can not guarantee its accuracy. Why A Reverse Sales Tax Calculator is Useful. 1 The type of taxing unit determines which truth-in-taxation steps apply.

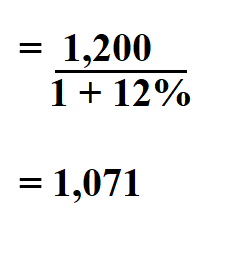

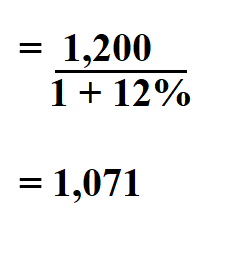

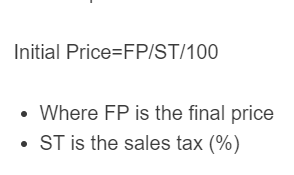

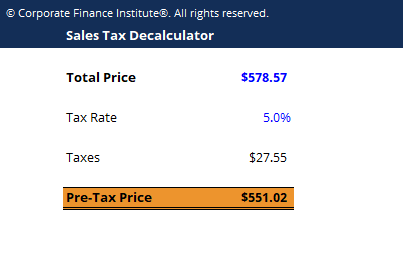

Pre Tax Price of Product Sale Price Post Tax Price 1 TAX RATE. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. In Texas can a reverse mortgage be approved if.

Calculate net price and sales tax amounts. Reverse Sales Tax Calculator 100 Free Calculators Io Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System. We can not guarantee its accuracy.

Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total taxable income.

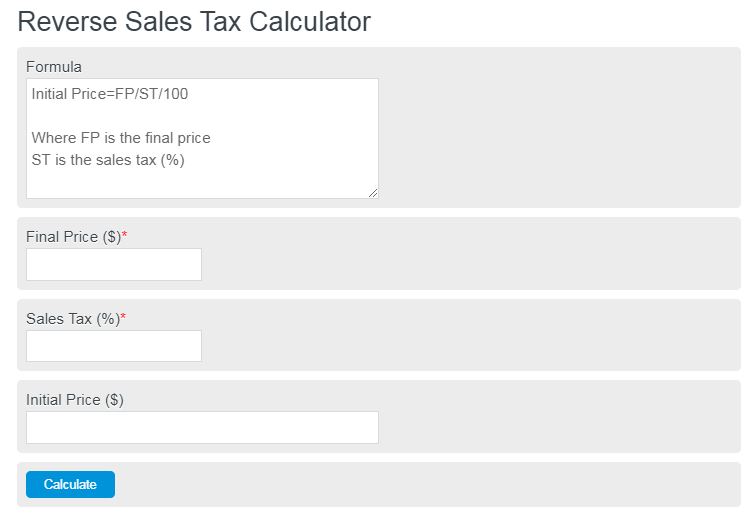

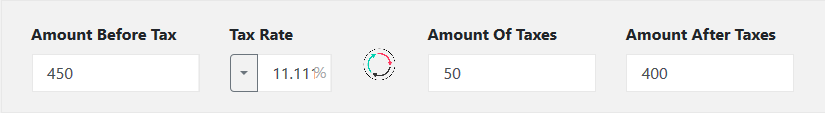

The formula is fairly simple. This script calculates the Before Tax Price and the Tax Value being charged. Before-tax price sale tax rate and final or after-tax price.

Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy. Reverse sales tax calculator texas Saturday February 26 2022 Edit. In Texas prescription medicine and food seeds are exempt from taxation.

To easily divide by 100 just move the decimal point two spaces to the left. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. In the Auckland region sales were down 34 compared to December 2020 and in the rest of the country excluding Auckland sales were down by 27 compared to the December 2020.

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. Cities counties and hospital districts may levy. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Multiply the result by the tax rate and you get the total sales-tax dollars. Subtract that from the receipts to get your non-tax sales revenue. This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012.

A drop down menu will appear. Enter the sales tax percentage. PRETAX PRICE POSTTAX PRICE 1 TAX RATE.

Amount without sales tax QST rate QST amount. 75100 0075 tax rate as a decimal. Input the Tax Rate.

Calculate Reverse Sales Tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. We can not guarantee its accuracy.

Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

This script calculates the Before Tax Price and the Tax Value being charged. And all states differ in their enforcement of sales tax. Vermont has a 6 general sales tax but an.

855-335-3500 New Car Sales. For example suppose your sales receipts are 1100 and the tax is 10 percent. Sales tax calculator to reverse calculate the sales tax paid and the net price.

Tax can be a state sales tax use tax and a local sales tax. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Formula s to Calculate Reverse Sales Tax.

Divide your sales receipts by 1 plus the sales tax percentage. Now find the tax value by multiplying tax rate by the before tax price. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate.

How To Charge Sales Tax Vat With Samcart Samcart

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calcurator Org

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Texas Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Find Original Price Tax 1 Youtube

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System